FEBRUARY 13 — Artificial Intelligence (AI) is rapidly reshaping industries worldwide, and Islamic banking and finance are no exceptions. Malaysia, a global leader in Islamic finance, is strategically integrating AI to enhance efficiency, risk management, and financial inclusion. As the country seeks to establish itself as a regional and global AI hub, its ability to leverage AI in Islamic finance will play a crucial role in determining its success. However, while AI presents immense opportunities, challenges such as talent shortages, regulatory gaps, and investment limitations must be addressed to ensure sustainable growth.

Malaysia’s dominance in Islamic finance is well-established, with Islamic banking assets accounting for 32.14 per cent of the global total (IFSB, 2023). The country leads in Sukuk issuance, Takaful, and Shariah-compliant investments, now integrating AI for automated compliance, fraud detection, robo-advisory services, and AI-driven risk assessment. This shift aligns with the National AI Roadmap 2021-2025 and MyDigital Blueprint, which aims to position Malaysia as a digital leader, targeting a 22.6 per cent GDP contribution from the digital economy by 2025, with Islamic finance as a key driver.

Further strengthening this vision, Budget 2025 includes an RM10 million allocation for the National Artificial Intelligence Office (NAIO), a strategic initiative to centralize and accelerate Malaysia’s AI ambitions. MyDIGITAL Corporation views this as a pivotal move toward making Malaysia a regional hub for AI-driven financial innovation and economic growth. One of the most promising applications of AI in Islamic finance is Shariah compliance automation. Ensuring that financial transactions adhere to Islamic principles requires extensive screening of contracts, transactions, and investments. Traditionally, this process has been manual, time-consuming, and prone to human error. AI-powered tools can now automate Shariah screening, analyze financial data at scale, and provide real-time compliance insights. This reduces costs for Islamic financial institutions while enhancing accuracy and efficiency.

Risk management in Islamic finance is another area where AI is making an impact. Unlike conventional banking, Islamic finance prohibits interest (riba) and speculative transactions (gharar), requiring alternative risk assessment methods. AI-driven models are being developed to predict credit risks, assess business viability, and enhance financial security without violating Islamic principles. Machine learning algorithms can analyze vast datasets to identify potential defaults, ensuring that Islamic banks make more informed lending decisions while maintaining ethical financial practices.

The rise of Islamic fintech (Islamic FinTech) has also been accelerated by AI. Digital banking platforms offering AI-powered robo-advisors are helping investors identify Shariah-compliant assets. AI-driven platforms for Zakat (charity), Waqf (endowments), and microfinance (Qard Hasan) are improving financial inclusion, ensuring that underprivileged communities can access ethical financial services. With the global Islamic fintech market projected to reach USD 179 billion by 2026, Malaysia has a unique opportunity to establish itself as a hub for AI-driven Islamic finance solutions.

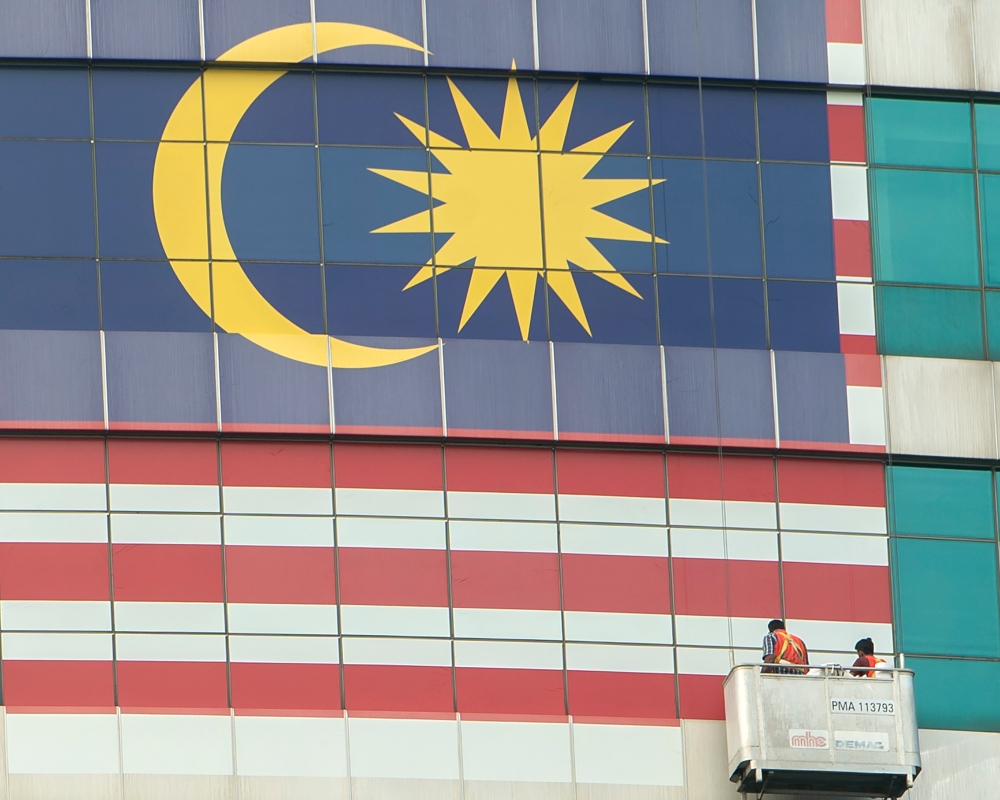

Malaysia’s dominance in Islamic finance is well-established, with Islamic banking assets accounting for 32.14 per cent of the global total (IFSB, 2023). — Picture by Shafwan Zaidon

Despite these advancements, challenges remain. One of the most pressing issues is the shortage of AI talent with expertise in Islamic finance. While Malaysia has a well-developed Islamic banking sector, integrating AI requires a workforce that understands both AI technology and Shariah financial principles. Universities and financial institutions must collaborate to develop specialized AI-Islamic finance programs, equipping professionals with the necessary skills to drive innovation.

Another major challenge is AI governance and ethical considerations in Islamic finance. While AI offers efficiency, it also raises concerns about bias in algorithmic decision-making, data privacy, and accountability. Since Islamic finance is deeply rooted in ethical principles, regulators must establish clear guidelines to ensure that AI applications align with Maqasid al-Shariah (the objectives of Islamic law). A comprehensive AI-Shariah governance framework is needed to address ethical risks while promoting responsible AI adoption.

Investment and infrastructure development are also critical factors in determining Malaysia’s AI leadership in Islamic finance. Compared to Singapore, Malaysia attracts fewer AI-related investments, particularly in the financial sector. While government-backed initiatives such as MDEC’s AI for Financial Services program are encouraging AI adoption, venture capital and private sector funding remain limited. Increasing investment in AI-driven Islamic finance startups and providing financial incentives for AI innovation can strengthen Malaysia’s position as a global hub.

Malaysia must take strategic steps to integrate AI into Islamic banking and finance more effectively to fully realize its potential. Expanding research and development (R&D) in AI for Islamic finance, promoting AI-based fintech startups, and strengthening Shariah-compliant AI governance is essential. Additionally, enhancing AI-driven financial literacy programs will ensure that customers and institutions can leverage AI-powered solutions responsibly.

As the global demand for Islamic financial services grows, Malaysia has a unique advantage to lead the transformation of AI in Islamic finance. By addressing current challenges and investing in AI-driven solutions, the country can solidify its role as an AI powerhouse in Islamic finance, influencing both regional and global markets. The next phase of AI in Islamic finance is not just about digitalization—it is about harmonizing technology with ethical financial principles to create a more inclusive and sustainable economic future.

*The authors are from the Institute of Islamic Banking and Finance (IIiBF), International Islamic University Malaysia.

**This is the personal opinion of the writers or publication and does not necessarily represent the views of Malay Mail.