KUALA LUMPUR, Nov 29 — Over half of Malaysians now use non-cash payment methods, with e-wallet adoption rising 14 per cent in 2024 compared to the previous year.

According to market research firm Ipsos, e-wallet usage was most popular among younger Malaysians, with the highest usage rates seen in the 18–24 age group.

In its report titled “Non-cash economy and the role of e-wallets”, it said the rise in e-wallet use has come at the expense of credits card usage that has seen a 3 basis point decline in the same period.

Over four in 10 respondents now use cashless payments daily, up 16 basis points from before, while an equal number said they paid online at least once a week.

“However, 45 per cent of Malaysians still rely solely on cash for payments,” the firm said in the report.

“To achieve the Malaysian government’s goal of a digital economy and a 90 per cent cashless payment rate by 2025, non-cash payment options, especially e-wallets, need to become more inclusive and accessible to those currently excluded.”

Cashless payments and transfers were highest in the central and southern parts of the peninsula, reflecting a growing reliance on digital payment solutions in urban areas.

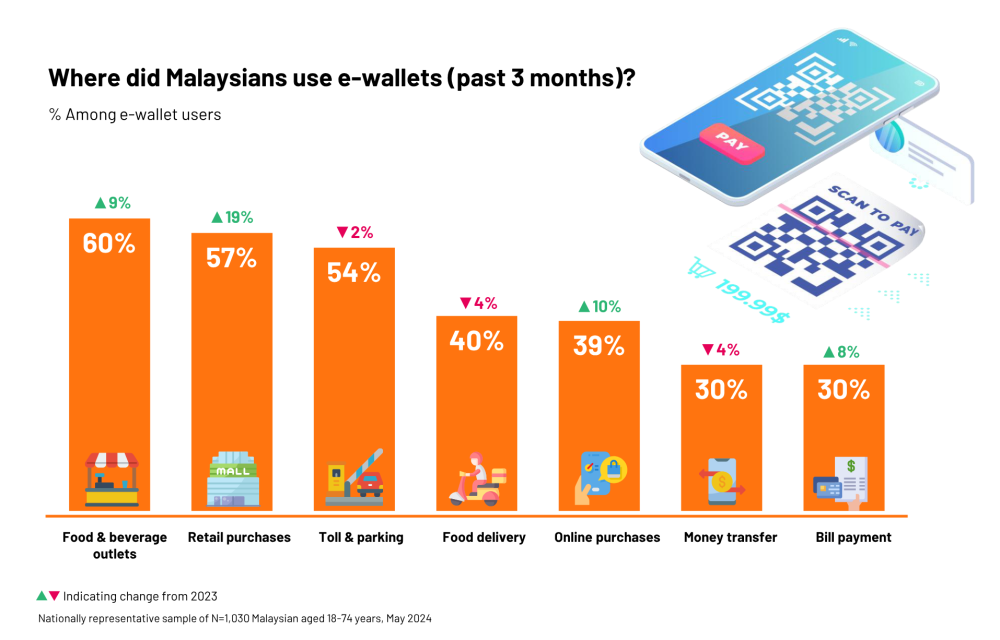

An infographics from Ipsos shows the change in Malaysians’ usage patterns for cashless patterns from 2023.

Food and beverage purchases (60 per cent) lead e-wallet transactions, followed by retail payments (57 per cent), while toll and parking transactions show slight declines.

Touch ‘n Go (92 per cent of users) retains its position as the most used e-wallet, with MAE (51 per cent) emerging as the second most popular platform. Both were magnitudes ahead of the third placed Shoppee Pay (10 per cent).

The push for cashless payments also go in tandem with the government’s introduction of e-invoicing, which it hopes will together improve tax compliance and enhance revenue collection.